Fleet breakdown cover is designed for businesses that own and operate multiple vehicles, and works in a similar way to regular breakdown cover. But is fleet breakdown cover right for your business?

What is fleet breakdown cover?

Fleet breakdown cover - often called business breakdown cover - covers all your business vehicles under one policy.

It is designed to help business owners get their vehicle(s) back on the road as quickly as possible following a breakdown.

What kind of businesses might need fleet breakdown cover?

- Delivery

- Haulage

- Construction

- Taxis

- Coaches, buses and minibuses

- Companies with highly mobile sales teams

Is fleet breakdown cover a legal requirement?

No, fleet breakdown cover is not a legal requirement in the UK, but it may be of value to some companies - especially those who operate multiple vehicles.

What are the benefits of fleet breakdown cover?

- Keep business vehicles moving - minimising financial losses

- Maintain reputation - ensuring vehicles are back serving customers promptly

- Quick and easy to request roadside assistance for a broken down fleet vehicle

- One policy for all fleet vehicles

- No wasting time finding a local garage

- Better cost management - i.e. no unexpected recovery bills

- Reassurance for drivers and fleet managers

- Less stress for drivers and fleet managers

Are there any limitations to fleet breakdown cover?

Each policy is different, so ensure you know what is - and what is not - covered. For example, coverage might not be provided for:

- Vehicles weighing more than 3.5 metric tonnes

- Vehicles wider than 2.5m

- Motorcycles under a certain cc (usually 121cc)

There may also be limitations on haulage, courier and taxi firms.

What types of add-on cover are offered with fleet breakdown cover?

Here's a quick rundown of the types of add-on cover you might be offered by a fleet breakdown cover provider. These are very similar to regular, non-business breakdown cover. Note that actual cover may differ between providers - and that some of these services may be provided as standard.

Roadside assistance

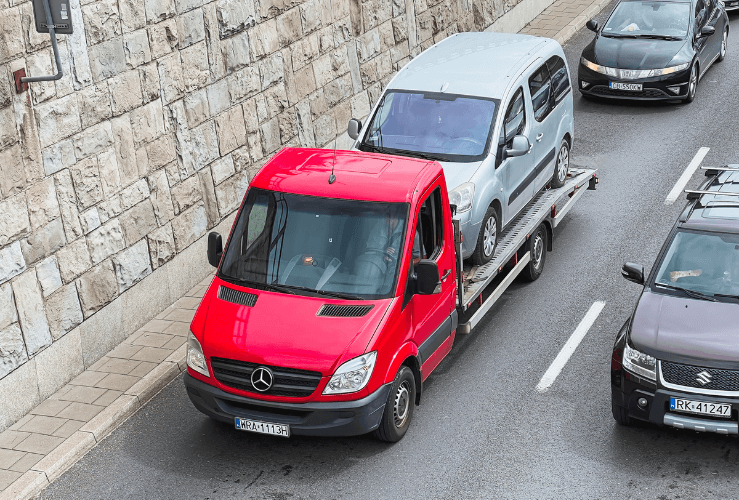

This is the most basic type of cover. It means if one of your business vehicles breaks down by the roadside, an operative will be sent out to carry out repairs. If a repair isn't possible, the vehicle will likely be towed to the nearest garage.

Nationwide recovery

A given fleet breakdown cover policy may or may not include 'nationwide recovery' as standard.

As the name suggests, this means a broken down vehicle will be recovered wherever it is in the UK. Some basic policies may only include 'local recovery' with a certain recovery distance - such as 10 miles.

Business address cover

This cover is similar to 'home' recovery on a regular policy. It would cover a vehicle if it breaks down at the business/registered address, or within a certain distance of it. This distance may vary among providers, but is usually within one mile.

Credit: AlexGo - stock.adobe.com

Europe cover

If your business fleet operates on mainland Europe, having a fleet breakdown cover policy could be beneficial. It's likely that if your provider is UK-based, they will have partnerships with EU-based recovery firms/operatives who can provide roadside assistance.

Onward travel

If the vehicle cannot be repaired, this cover ensures the driver is provided with a comparable vehicle, or onward travel by public transport.

If the intended journey cannot be completed that day (perhaps because it is evening time), the provider will also pay for overnight accommodation.

Misfuelling cover

This covers you if the wrong fuel is put into the vehicle - e.g., diesel fuel in a petrol engine, or vice-versa. It may also cover the cost of having the fuel drained, flushed, and having the tank refilled with the correct fuel.

Lost keys

This type of cover ensures your keys are replaced if they are lost, stolen, or damaged. If the electrics need to be reprogrammed, this will likely be covered, too. A hire vehicle may also be provided while keys are being replaced.

Tyre replacement

Most cover policies will cover your business for puncture repairs as standard. But this cover add-on will entitled you to a certain number of replacement tyres in a given year.

Read the policy document carefully

It’s important to understand what is and isn’t covered by a fleet breakdown cover policy before you buy it. If you have certain expectations or needs from your coverage, ensure these are included.

A little time spent reading this document could save you time, money and stress later on.

Note that the cheapest policy may not be the right one for your business needs.