All vehicles driven or kept on UK public roads must pay tax. How much you’ll pay depends on a number of variables, including CO₂ emissions, fuel type (or power source), and the vehicle’s list price. Sorting it out can seem complex given the many categories. It’s essential to include road-tax in your annual motoring budget to avoid penalties, and to know when and how to tax your vehicle.

What is vehicle tax (VED) used for?

In theory, road tax is meant to contribute to the upkeep and maintenance of the UK’s road network. In practice, payments go into the Treasury, contributing indirectly to a range of state costs, from policing and health to road upkeep and broader public services.

Is my car taxed?

You can find out if your car - or any other car - is taxed by visiting Gov.uk. This service will also tell you if a vehicle has a Statutory Off Road Notification (SORN).

You’ll need to enter the car’s registration number.

How can I check my car's tax and mot?

The same Gov.uk link can be used to check the MOT status of a vehicle, as well as its car tax status.

How much is my car taxed?

You can check the cost of road tax by looking at the tables further down this page.

Value, fuel type, and emission all have an impact on the final cost.

Cars first registered on or after 1 April 2017

From 1 April 2025, all cars, including zero-emission vehicles are subject to the updated tax bands. If the vehicle’s list price (before discounts) was over £40,000, there is an extra “Expensive Car Supplement” (ECS), currently £425 per year, payable from the second year for five years.

When is my car's tax due?

As above, you can find out when your car tax is due by entering your registration into this government page.

Tax is payable from the date your car was first registered, and is payable on the same day each following year.

What is the cheapest car tax band?

Under the old “car tax bands UK” system (for cars registered March 2001 – March 2017) the cheapest band was Band A (≤100 g CO₂) now costing £20 per year under 2025/26 rates.

For cars first registered from April 2017 onwards, a zero-emission vehicle now pays £10 in the first year, and £195 per year thereafter (if below the expensive-car threshold).

Credit: Gary L Hider - stock.adobe.com

You do not have to pay car tax if your vehicle:

- is brand new and produces 0 grams of CO2, and costs under £40,000

- was registered between 1 March 2001 and 1 April 2017, and produces 100 grams or less of CO2 per kilometre

If you're a motorist with a disability you may be exempt if:

- you own a mobility scooter or other 'invalid carriage'. NB: Class 3 mobility scooters/powered wheelchairs are exempt

- you get the War Pensioners' Mobility Supplement

- you receive the enhanced Mobility Component of the Personal Independence Payment

Car tax for diesel vs petrol vehicles

Diesel- and petrol-fuelled cars follow exactly the same Vehicle Excise Duty bands as shown above; fuel type in itself no longer changes the VED rate. The tax you pay depends only on CO₂ emissions and list price (for the ECS), rather than whether you drive petrol or diesel. This simplifies the system and avoids penalising one fuel type over another.

Car tax for hybrid vehicles

Hybrid cars, including plug-in hybrids are taxed based on their CO₂ emissions under the same “car tax bands UK” scheme used for petrol and diesel cars. For a hybrid, the first tax payment (first year) depends on emissions; from the second year, the flat standard rate applies (plus ECS if list price exceeded £40,000). As of 2025, hybrids are no longer automatically granted a discount simply for being a “green” option.

Recent change: Electric vehicles are no longer tax-free (for many)

A major shift came into effect from 1 April 2025 under new regulations from the government. Previously, zero-emission vehicles (EVs) were often exempt but the exemption has been largely removed.

- All new zero-emission cars registered on or after 1 April 2025 now pay £10 in their first year.

- From the second year onwards, they pay the standard VED £195 per year.

- If the EV’s list price was over £40,000, the Expensive Car Supplement now applies (as £425 a year, for five years).

- However, from 1 April 2026, the threshold for the ECS for zero-emission cars will increase from £40,000 to £50,000. That means EVs between £40,000 and £50,000 may escape the extra charge from that date.

This change significantly reduces the tax advantage previously enjoyed by many EVs, something all prospective buyers should now factor into total cost of ownership.

Credit: Ascannio - stock.adobe.com

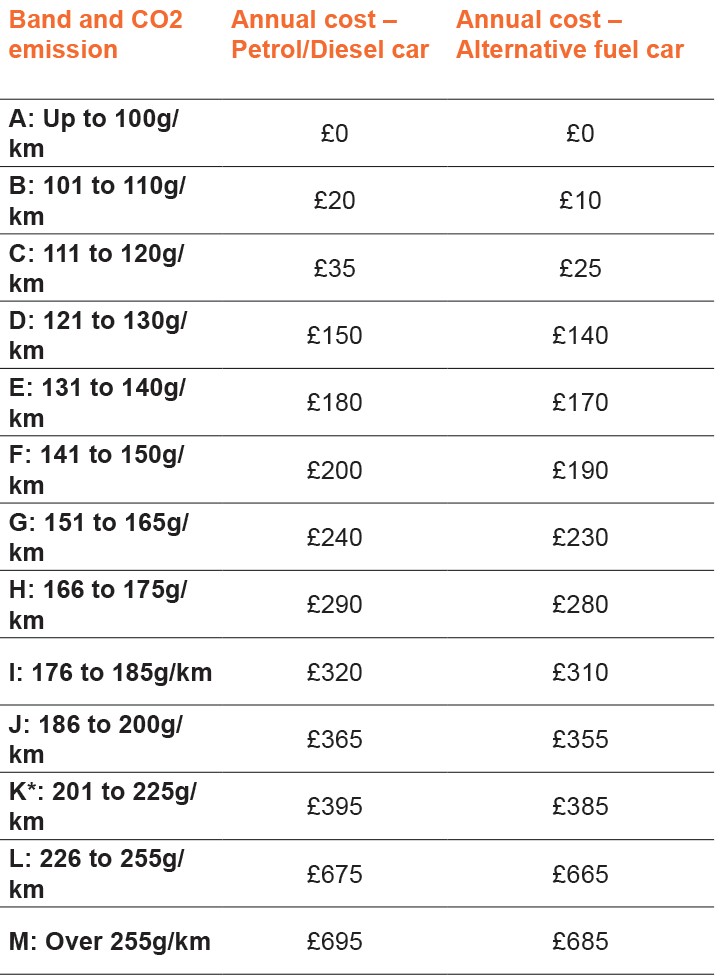

Cars first registered between 1 March 2001 and 31 March 2017

For cars in this age bracket, vehicle tax is still based on CO₂ emissions (the traditional “car tax bands UK” system). As of 2025/26, bands have been uprated.

- Band A (up to 100 g/km CO₂): £20

- Higher bands: start from £35 and rise, in some cases up to £760, depending on emissions and age.

Why the system exists and recent policy goals

The structure of vehicle tax rates has long been intended to encourage cleaner, lower-emission cars and reduce overall vehicle emissions. However, rising numbers of newer cars meeting low CO₂ thresholds have weakened the environmental signal under the older system.

The 2025 changes, especially charging EVs and hybrids more like traditional cars, reflect a shift towards a simpler and fairer road-tax system, and an attempt to ensure all cars contribute to public finances. Unfortunately, this also means the tax incentive for zero-emission cars has been significantly reduced.

What this means for you as a motorist (especially in 2025–26)

- If you drive or plan to buy a new electric vehicle: from 2025 most will no longer be tax-free, expect to pay at least £10 in year one and £195 per year thereafter.

- If your car is relatively new (post-2017) and expensive (> £40,000 list price), budget for the Expensive Car Supplement for years 2–6.

- Hybrids and lower-emission petrol/diesel cars are taxed the same as conventional cars so check the CO₂ emissions carefully to estimate the first-year and ongoing tax.

- Older cars (2001–2017) with low emissions remain among the cheapest to tax sometimes significantly cheaper than newer vehicles.

CO2 emissions | Diesel cars (TC49) that meet the RDE2 standard and petrol cars (TC48) | All other diesel cars (TC49) |

0g/km | £0 | £0 |

1 to 50g/km | £10 | £30 |

51 to 75g/km | £30 | £130 |

76 to 90g/km | £130 | £165 |

91 to 100g/km | £165 | £185 |

101 to 110g/km | £185 | £210 |

111 to 130g/km | £210 | £255 |

131 to 150g/km | £255 | £645 |

151 to 170g/km | £645 | £1,040 |

171 to 190g/km | £1,040 | £1,565 |

191 to 225g/km | £1,565 | £2,220 |

226 to 255g/km | £2,220 | £2,605 |

Over 255g/km | £2,605 | £2,605 |

How you pay can affect your car tax rate

The exact amount you pay will vary depending on if you pay monthly, six-monthly, or using the Direct Debit system.

The cheapest option is to pay upfront for the entire year.

Why the system exists and recent policy goals

The structure of vehicle tax rates has long been intended to encourage cleaner, lower-emission cars and reduce overall vehicle emissions. However, rising numbers of newer cars meeting low CO₂ thresholds have weakened the environmental signal under the older system.

The 2025 changes, especially charging EVs and hybrids more like traditional cars, reflect a shift towards a simpler and fairer road-tax system, and an attempt to ensure all cars contribute to public finances. Unfortunately, this also means the tax incentive for zero-emission cars has been significantly reduced.

What this means for you as a motorist (especially in 2025–26)

- If you drive or plan to buy a new electric vehicle: from 2025 most will no longer be tax-free, expect to pay at least £10 in year one and £195 per year thereafter.

- If your car is relatively new (post-2017) and expensive (> £40,000 list price), budget for the Expensive Car Supplement for years 2–6.

- Hybrids and lower-emission petrol/diesel cars are taxed the same as conventional cars so check the CO₂ emissions carefully to estimate the first-year and ongoing tax.

Older cars (2001–2017) with low emissions remain among the cheapest to tax sometimes significantly cheaper than newer vehicles.

Credit: Trygve - stock.adobe.com

Rates - Official CO2 emissions: