On October 1 2014 the DVLA made road tax non-transferable, a move that caused some confusion for those buying and selling used cars.

At the same time, the tax disc to show motorists have paid vehicle excise duty was replaced with an electronic system.

Road tax is a legal requirement so it is important to understand how to tax a car, van, motorbike, or any other eligible vehicle that you may own.

In this article we’ll explain:

- What you need to do to tax your vehicle

- Alternative ways to pay road tax other than online – over the phone and via a Post Office

- Road tax costs

- How to check your vehicle’s road tax status; and

- The penalties you may face for not having the appropriate road tax in place.

What is the DVLA?

The DVLA (Driver and Vehicle Licensing Agency) is the body responsible for the registration and licensing of drivers and vehicles in Great Britain.

The DVLA also holds the responsibility for the collection and enforcement of road tax (VED).

Pay car tax online

The quickest and simplest way to renew road tax or pay road tax for a new vehicle, is to pay your car tax online.

Taxing your car can be done 24 hours a day using the government's online system at www.gov.uk/tax-disc.

What do I need to pay vehicle tax online?

One of the following is required to pay your vehicle tax online:

- V11 - a 16-digit reference number detailed on your vehicle tax renewal letter

- V5C - an 11-digit reference number on your vehicle's log book

- V5C/2 - If you've just purchased a vehicle, this is the 12-digit reference number on your new keeper supplement

You can pay for road tax online using a debit or credit card, or by Direct Debit.

How do I tax a new car?

As mentioned above, if you've just purchased a new car, you can use the 12-digit reference number on your new keeper supplement (V5C/2) to pay your vehicle tax online.

The V5C/2 for my car has less than 12 digits: How do I pay road tax online?

Some older cars may have a reference number of fewer than 12 digits. You can still arrange your road car tax renewal with the DVLA through this link: Tax your vehicle - GOV.UK (www.gov.uk)

Can I tax my vehicle by phone?

If you don’t wish to pay your road tax online, it is instead possible to pay for your vehicle tax by phone.

Phone number to pay UK road tax

You can call 0300 123 4321 (textphone 0300 790 6201) to pay your road tax.

The process is automated and takes just a few minutes. However, you cannot arrange road tax payment by Direct Debit by phone.

Local rate charges apply.

Can I pay for my road tax at the Post Office?

Another alternative to paying your road tax online, most Post Offices still let you pay your road tax at the counter. You can pay for your vehicle tax at the Post Office by debit/credit card, or Direct Debit payments.

You can find details of your local post office by using the Post Office Branch Finder

What documents do I need to pay road tax at the Post Office?

To pay for your vehicle tax at a local Post Office, simply take along your V11 reminder, V5C or new keeper supplement (V5C/2).

If you don’t have any of these, you’ll need to apply for a new V5C. You will need to complete a V62 form, which you can pick up at your Post Office. The cost is £25.

You may also need your up-to-date MOT test certificate, which must still be valid at the time the tax period begins.

You’ll also need to know the payment sum detailed on the road tax renewal reminder in order to pay for your vehicle tax at the Post Office.

Which Post Offices let me pay over-the-counter?

You can find a Post Office that accepts vehicle tax payments by entering your postcode on this page: https://www.postoffice.co.uk/identity/vehicle-tax

What if I'm exempt from vehicle tax payment?

If you're exempt from paying road tax - e.g. because you're disabled, or you have an electric vehicle or your vehicle was made before 1 January 1981 - your vehicle must still be taxed.

If you qualify as being exempt from paying road tax due to being registered disabled, your exemption is only applicable for one vehicle at any time. If you have more than one vehicle, you’ll need to choose which one will be exempt from vehicle tax.

How do I tax an exempt vehicle?

It is possible to arrange road tax for exempt vehicles online, via telephone or at most post offices.

If you claim disabled vehicle tax and intend on taxing your exempt vehicle at a post office you will need a valid Exemption Certificate in addition to your V11 reminder, V5C or new keeper supplement (V5C/2) and your up-to-date MOT test certificate.

Changing your car’s tax class to or from ‘disabled’

You may need to change your vehicle’s tax class, for example if either:

- your car was previously used by a disabled person

- you’re disabled and taxing your car for the first time

You can only apply at a Post Office to change your car tax class.

Paying vehicle tax in advance

You can tax your vehicle up to 2 months before it expires if you’re going to be away from home (eg on holiday) when your current vehicle tax runs out.

To arrange to pay your road tax in advance, you can apply by post before you go.

What documents do I need to pay vehicle tax in advance?

You need to send the following documents and payment for your road tax to the DVLA:

- your V5C registration certificate (log book)

- a letter explaining why you’re applying for your vehicle tax in advance

- a completed application for vehicle tax (V10) or application to tax a heavy goods vehicle (V85)

- an MOT or goods vehicle testing (GVT) certificate (if you need one) - it must be valid when the new tax starts

- a cheque, postal order or banker’s draft to pay for your vehicle tax made payable to ‘DVLA Swansea’ - damaged or altered cheques will not be accepted.

Renew car tax online whilst away from home

If you don’t want to apply for your car tax in advance, you can pay your vehicle tax online while you’re away from home.

What documents do I need to renew car tax online?

You’ll need the following to pay your car tax online:

- V5C vehicle registration certificate (log book) number

- vehicle registration number

From what date can I renew car tax online?

You can only renew car tax online from the 5th of the month that the renewal is due.

For example, you can pay road tax online from 5 March if your vehicle tax runs out on 31 March.

Why can’t I pay my car tax online?

If you’re trying to pay car tax online but are having no success, there could be one of several reasons as to why your car tax online payment is not processing.

Incomplete or outdated information

You will not be able to tax your car online with your V5C/2 new keeper slip if the car has not yet been registered in your name. You must first, send this form back to the DVLA.

If the information on your V5C/2 or V5C logbook is incomplete or outdated, this is likely to also prevent you from being able to tax your car online.

Make sure all of your information, including vehicle details are correct as any errors in your details such as address, name, or vehicle details affect the processing of your car tax application.

If you need to make any changes to the information on file, this must be done via the DVLA. The DVLA will then send you a new V5C, after which, you can look to pay your car tax online.

No car insurance in place

You need to have a valid car insurance policy in order to tax your car. If your insurance policy has lapsed or is incorrectly in the Motor Insurance Database (MID), you won’t be able to complete your car tax application.

Your renewal date is outside of the valid car tax renewal time period

You may be attempting to pay for your car tax online too far ahead of the tax renewal date. You can only renew car tax online from the 5th of the month that the renewal is due.

Your MOT has expired

In order to tax your car, you need a valid MOT unless:

- Your car is under 3 years old

- Your car is MOT exempt

If your MOT certificate is not valid on the start date of your vehicle tax or the date it is issued, you will be unable to pay your car tax online until your get a new MOT certificate.

Note: It can take up to 2 days for MOT information to be updated, so you might not be able to tax your vehicle immediately after it passes its MOT test.

How much road tax will I have to pay?

How much you pay depends upon the tax band your car is in.

In an effort to reduce emissions and hit targets, the government taxes polluting cars more heavily.

Most expensive cars also pay more car tax: if your car has a list price of more than £40,000, you’ll need to pay an extra £335 a year in VED - for five years from the second time that the vehicle is taxed.

The cleaner your car, the less road tax you’ll pay.

Do I need to pay road tax for my electric vehicle?

Since April 2020, zero emission battery EVs (BEVs) do not attract any VED at all - either in the first year or any subsequent year.

Car tax costs for cars registered between 1 March 2001 and 31 March 2017

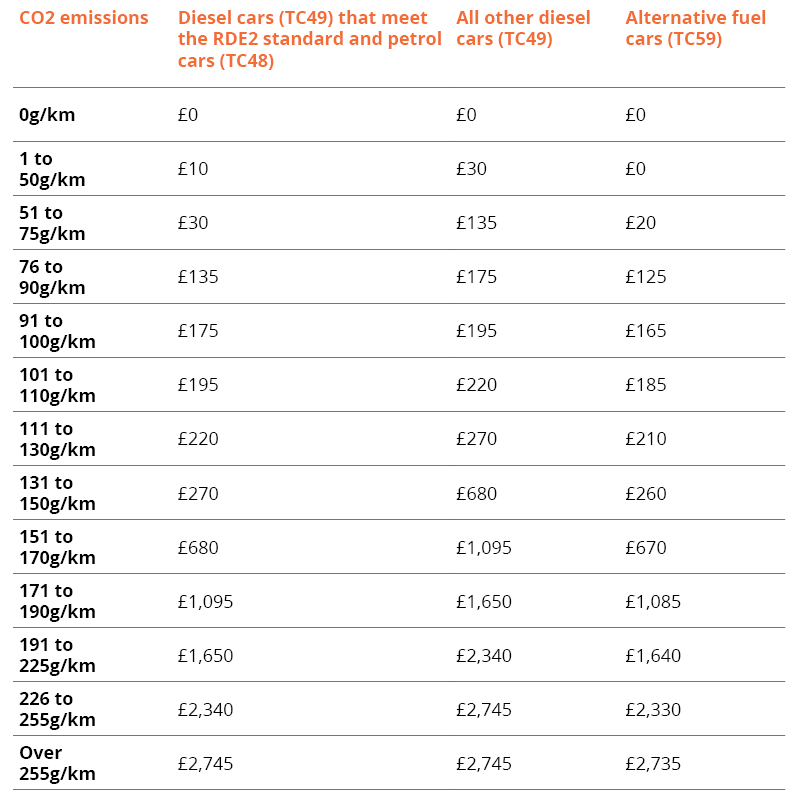

Petrol car (TC48) and diesel car (TC49)

*Includes cars with a CO2 figure over 225g/km but were registered before 23 March 2006.

Alternative fuel car (TC59)

*Includes cars with a CO2 figure over 225g/km but were registered before 23 March 2006.

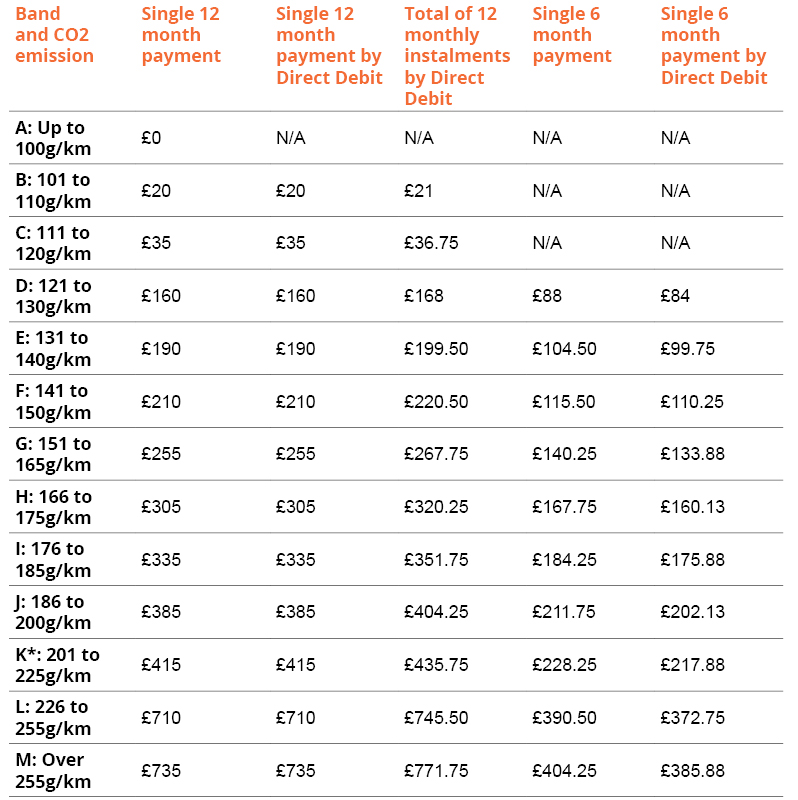

Car tax costs for cars registered on or after 1 April 2017 – Charges for first year the vehicle is registered

This payment covers your vehicle for 12 months

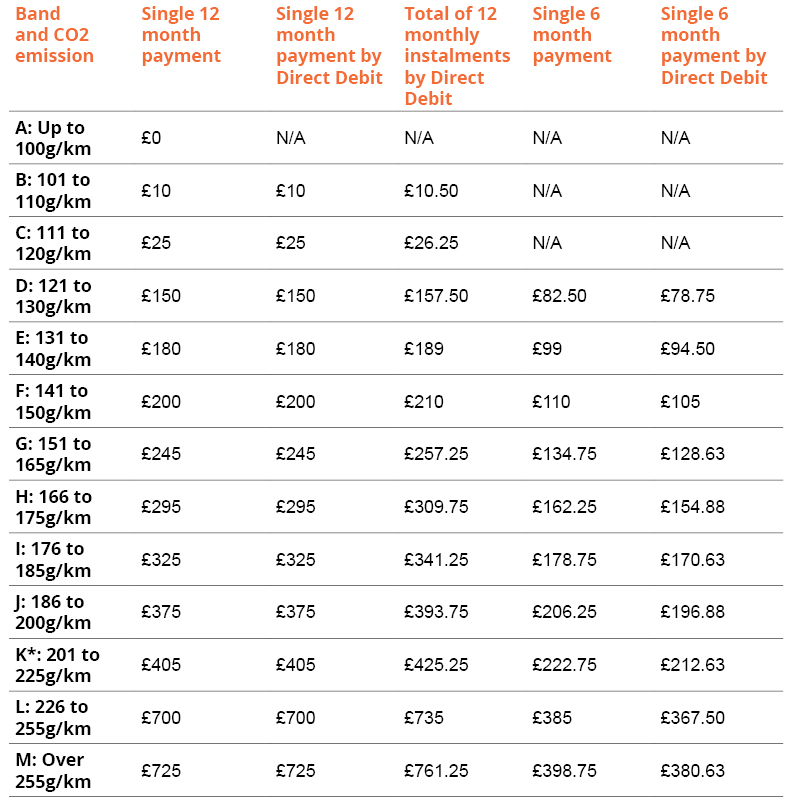

Car tax costs for cars registered after 1 April 2017 – Standard annual charges for second year onward

Alternative fuel vehicles include hybrids, bioethanol and liquid petroleum gas.

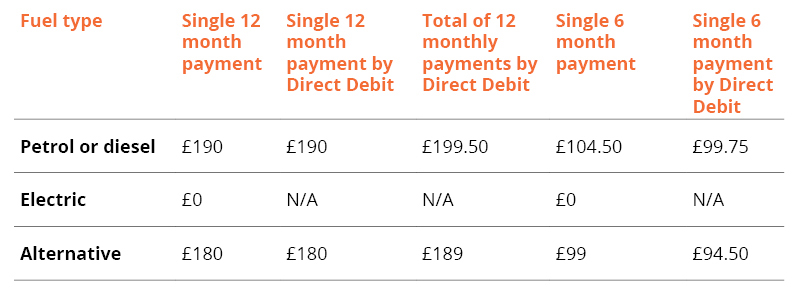

Car tax costs for cars registered before 1st March 2001

In this case, the annual payable car tax is based on engine size:

- For engines up to 1549cc - £200.00 per year.

- For engine sizes over 1549cc - £325.00 per year.

Road tax online payment options

When arranging your road tax online payment, you can choose to pay via credit or debit card, or by Direct Debit payments.

There are three different options for road tax Direct Debit payment frequency. You can choose to pay road tax payments as:

- Monthly payments (12 instalments)

- Payments once every 6 months

- Paying once each year

The amount you pay for your vehicle tax depends on how often you want to make a payment. There’s a 5% surcharge if you pay your vehicle tax by direct debit on a monthly basis, or every 6 months. There’s no surcharge if you pay your vehicle tax yearly.

The importance of paying VED

The most compelling reason for paying your VED is of course that it’s illegal not to unless your car is SORN.

The only exception to this rule is if you’re taking your car to a pre-booked MOT test, when you can legally drive your vehicle on a road without it being taxed.

Not having valid vehicle tax in place could possibly invalidate your insurance, even if you are not driving the vehicle. Some insurance companies stipulate having valid tax in place as a condition of insurance, so it’s important to check your policy wording.

Driving without vehicle tax could also land you with hefty fines, and even result in having your car towed away.

Penalties for driving an untaxed car

If you’re caught driving without road tax, you’ll face a DVLA-imposed fine of £80.

There is a 50% discount if this is paid within 28 days. However, if the case goes to court, you could face a fine of up to £1,000 or five times the due road tax.

If you use a vehicle on a public road when it is SORN, the penalty is either £2,500 or five times the amount of tax.

Why do we pay road tax in the UK?

Road tax (VED) is now part of the UK’s general taxation system and goes towards repairing and upgrading our road network.

What will happen if I drive my vehicle without taxing it?

If you drive an untaxed vehicle on a public road, except in the case of driving your vehicle to a pre-booked MOT test, you could be fined up to £1,000 if caught.

The police and local council also how the powers clamp or tow a vehicle that doesn’t have valid road tax, which will incur further costs.

If your vehicle is impounded, the full statutory fees must be paid before the vehicle is released.

For further details on driving without road tax, read our complete guide to driving without tax.

How do I check the tax status of my vehicle?

You can check the tax status of your vehicle online using the Government vehicle enquiry service.

As well as confirming if your vehicle has valid road tax, this service will also provide details as to the date your MOT is next due.

DVLA-scam emails

In recent years there has been a rise in spam emails purporting to be from the DVLA and offering refunds on road tax payments.

In response to these scam emails, the DVLA said, “We don’t send emails or text messages that ask you to confirm your personal details or payment information, such as for a vehicle tax refund.

If you get anything like this, don’t open any links and delete the email or text immediately.”

What does SORN mean?

SORN stands for Statutory Off Road Notification. You must make one if you plan to stop using your car for a while - while ceasing payments of insurance and road tax (VED). Learn more about what is SORN and declaring a vehicle off the road.

How do I cancel my road tax online?

You may need to cancel your road tax. For example:

- You have sold or transferred your car to someone else

- You have declared your car as SORN

- Your car has been written off by your insurance company

- You have scrapped your car at a vehicle scrapyard

- Your car has been stolen

- Your car has been exported out of the UK

- You are registered as exempt from vehicle tax

In most instances, it is possible to cancel road tax online.

Simply select the relevant link on the DVLA website, for the reason you wish to cancel your road tax, and complete the requested details

How do I get a tax refund?

Once you have told the DVLA that you wish to cancel your road tax, you’ll automatically get a refund for any full months left on your vehicle tax.

The refund is calculated from the date DVLA gets your information and a cheque sent to the name and address on the vehicle log book.

If you pay your vehicle tax by Direct Debit, the Direct Debit will be cancelled automatically.

If you’re looking for breakdown recovery, car roadside assistance or breakdown insurance, then join the thousands of UK motorists that rely on car breakdown cover from startrescue.co.uk.